The traditional one-size-fits-all approach to payment terms is proving to be increasingly inflexible and limiting. So, enter the era of Flexible Payment Terms.

Just as businesses tailor their offerings to meet the unique needs of their clients, there’s an emerging need to personalise the financial engagements that underpin these transactions. Imagine a business environment where payment terms reflect the unique needs, challenges, and capacities of both buyers and sellers.

A realm where businesses can swiftly adapt to market volatilities, not by redefining their core offerings, but by adjusting their financial engagements. This isn’t just a vision of the future; it’s a present-day solution that’s reshaping the way we think about Cash Flow Management in B2B transactions.

The journey to adopting flexible payment terms begins with understanding their significance and the transformative benefits they can usher into B2B commerce. As we delve deeper, we’ll explore how reimagining payment terms can not only alleviate cash flow bottlenecks but also lay the foundation for long-lasting, mutually beneficial buyer-seller relationships.

This will enable businesses to capitalise on emerging opportunities with unparalleled financial agility.

How Important is Flexible Payment in B2B Transactions?

In the dynamic world of B2B transactions, payment terms aren’t just a clause in a contract; they form the backbone of every financial engagement.

Their influence goes beyond mere dates and deadlines. They dictate the rhythm of cash flow, shape business relationships, and play a crucial role in determining a company’s agility in responding to market conditions.

Especially in burgeoning markets like B2B Commerce India, where the financial landscape is evolving rapidly, businesses are always seeking ways to optimise their operations. As CFOs, finance managers, and decision-makers, it is essential to recognize that in the face of this ever-changing financial terrain.

This is where flexible payment terms make a world of difference.

What are Traditional Payment Terms in B2B?

For as long as B2B transactions have existed, payment terms have been their silent architects, governing the financial interactions between businesses. Historically, these terms have been characterised by their rigidity, often established as non-negotiable stipulations set in stone. The classic net-30 or net-60 days approach, for instance, became a ubiquitous standard across many industries, with little regard to the specific needs or capacities of the parties involved.

In the bustling market of B2B Commerce India, this conventional approach held sway for a long time. With businesses laser-focused on their deliverables and offerings, payment terms became an overlooked aspect, regarded as a mere procedural necessity rather than a strategic component.

This rigidity often led to a cascade of challenges.

Cash Flow Bottlenecks

First and foremost, such inflexibility resulted in inevitable cash flow bottlenecks. Companies found themselves either awaiting payments, which hindered their ability to reinvest or expand, or grappling with hefty bills that strained their reserves.

Either way, Cash Flow Management was often reactive, with businesses constantly firefighting rather than proactively managing their resources.

No Transparency

Additionally, the uncompromising nature of these traditional payment terms fostered a purely transactional relationship between buyers and sellers. Instead of mutual growth and understanding, interactions became a tug of war, each party trying to safeguard its interests.

In a setting where both parties are vulnerable to Financial Risk in B2B, such transactional relationships often lead to mistrust and hesitancy, stunting potential collaborations and long-term partnerships.

Rigid Terms and Conditions

Furthermore, with market conditions, economic climates, and business needs being ever-evolving, the rigidity of traditional payment terms proved to be a severe limitation. Companies, irrespective of their scale or domain, yearned for flexibility to adapt to unexpected shifts, seasonal demands, or unique challenges.

Without the capacity to modify payment terms based on situational needs, many businesses missed out on opportunities or found themselves cornered in unfavourable scenarios.

What Are Flexible Payment Terms?

As businesses worldwide recognize the limitations of traditional payment structures, a paradigm shift is underway. Stepping into the limelight are Flexible Payment Terms—a more adaptive, dynamic approach to financial engagements in B2B commerce.

At its core, flexible payment terms refer to customizable financial agreements tailored to the specific needs, capacities, and challenges of both buyers and sellers involved in a transaction. Unlike the one-size-fits-all approach inherent to traditional models, flexible terms allow businesses to adjust payment schedules, amounts, and conditions based on mutual discussions and evolving scenarios.

Let’s delve deeper into the key differentiators:

Why Personalization Over Standardization?

While traditional payment terms, such as net-30 or net-60, offer predictability, they often overlook the unique financial dynamics of individual businesses. Flexible payment terms, on the other hand, cater to the individual needs of companies.

Whether it’s a start-up operating with tight cash flow or an established entity with seasonal revenue fluctuations, flexible terms can be crafted to align with their specific financial landscapes.

How Important is Dynamic Adaptability?

Market volatility is a given, especially in burgeoning sectors like B2B Commerce India. With traditional models, businesses are bound to pre-defined terms, making it challenging to adapt to unexpected market shifts.

Flexible payment terms shine here, allowing businesses to recalibrate their financial agreements in response to unforeseen events, economic changes, or strategic shifts, ensuring optimal Cash Flow Management.

What is Collaborative Approach?

Traditional payment structures often inadvertently pitch buyers and sellers against each other, with each trying to minimise its Financial Risk in B2B. Flexible terms herald a more collaborative era.

By fostering open discussions and mutual adjustments, they transform transactional engagements into strategic partnerships, where both parties work together for mutual benefits.

How Crucial is Risk Mitigation?

One of the pivotal aspects of B2B Financial Optimization is managing and mitigating risks. Flexible payment terms offer a safety net.

By allowing businesses to adjust their terms based on real-time assessments and feedback, they can better navigate financial uncertainties and safeguard against detrimental impacts.

What are the Benefits of Flexible Payment Terms for Sellers?

Embracing the dynamic approach of flexible payment terms is not just a trend but a strategic move that offers a plethora of benefits, especially for sellers in the B2B arena. The days of static, one-size-fits-all payment models are being overshadowed by this adaptable approach, particularly evident in rapidly growing markets like B2B Commerce India.

Here’s a deep dive into the multifaceted advantages sellers stand to gain:

- Enhanced Cash Flow Management

One of the primary advantages of adopting flexible payment terms is the improved control over Cash Flow Management. By tailoring payment schedules to align with a company’s operational and financial cycles, sellers can ensure a more predictable and consistent cash inflow.

This not only helps in meeting short-term financial obligations but also aids in making informed decisions about reinvestments, expansions, and other long-term strategies.

- Strengthened Buyer-Seller Relationships

In the traditional transactional framework, the relationship between buyers and sellers often remained at a superficial level. With flexible payment terms, there’s an inherent emphasis on collaboration and understanding.

By accommodating a buyer’s financial constraints and needs, sellers foster a sense of partnership. This mutual respect and cooperation pave the way for long-lasting business relationships, recurring transactions, and increased loyalty.

- Reduced Financial Risk

One of the looming challenges in any B2B Financial Optimization strategy is the mitigation of risks. Fixed payment terms can sometimes expose sellers to heightened risks, especially if buyers face sudden financial challenges.

Flexible terms, however, provide a buffer. By allowing periodic reassessments and adjustments, sellers can adapt to changing circumstances, ensuring they’re not left high and dry due to unforeseen market volatilities or buyer-specific issues.

- Competitive Edge in the Marketplace

In an increasingly competitive market, offering flexible payment terms can be a significant differentiator. It showcases a seller’s commitment to accommodating the needs of its clients, making them more appealing to potential buyers.

This adaptability can be a pivotal factor in attracting new business, retaining existing clients, and ensuring sustained growth.

- Proactive Response to Market Dynamics

Especially relevant in volatile markets, the flexibility in payment terms equips sellers with the agility to respond to market changes proactively. Whether it’s an economic downturn, a sudden surge in demand, or regulatory shifts, sellers can recalibrate their terms, ensuring they remain resilient and responsive.

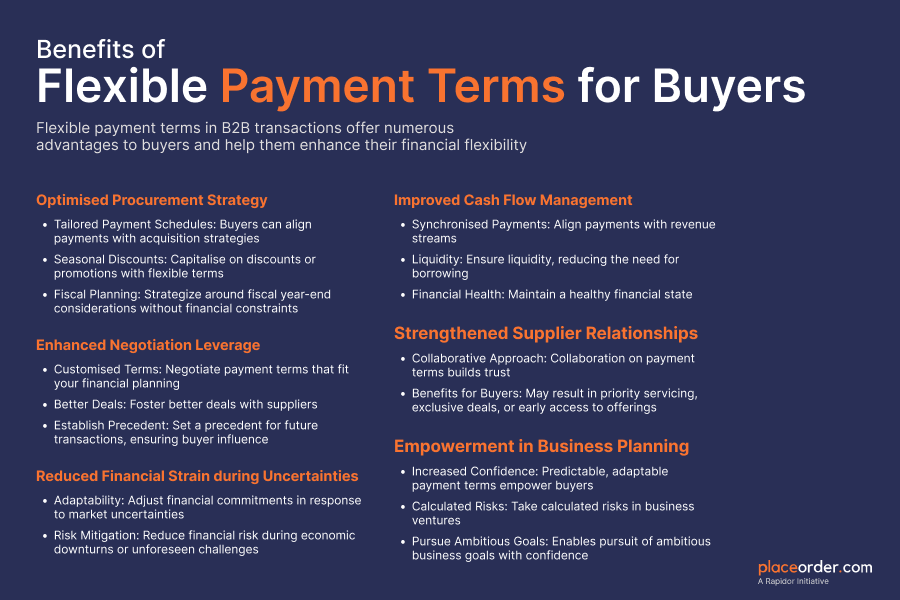

What are the Benefits of Flexible Payment Terms for Buyers?

In the B2B ecosystem, the ripple effects of flexible payment terms are not limited to sellers alone. Buyers, often at the receiving end of stringent payment conditions, stand to gain immensely from this adaptive approach.

As the momentum of B2B Commerce India surges, the demand for financial flexibility by buyers becomes even more pronounced. Here’s a detailed exploration of the myriad advantages that flexible payment terms offer to buyers:

- Optimised Procurement Strategy

A key concern for many buyers is ensuring a seamless procurement process. Flexible payment terms provide buyers with the ability to tailor their payment schedules based on their acquisition strategies and financial health.

Whether it’s bulk purchasing during promotional periods, capitalising on seasonal discounts, or strategizing around fiscal year-end considerations, flexibility in payment empowers buyers. This helps them make optimal procurement decisions without being bound by rigid financial constraints.

- Enhanced Negotiation Leverage

In any B2B negotiation, the ability to adjust payment terms can be a potent tool in a buyer’s arsenal. Instead of being pigeonholed into predefined structures, buyers can negotiate terms that align with their financial planning.

This not only fosters better deals but also establishes a precedent for future transactions, ensuring that buyers always have a say in shaping their financial engagements.

- Improved Cash Flow Management

For buyers, managing outflows is as critical as managing inflows. Flexible payment terms facilitate more effective Cash Flow Management by allowing buyers to synchronise their payments with their revenue streams.

By aligning payments with their cash inflows, buyers can ensure liquidity, avoid unnecessary borrowing, and maintain a healthy financial state.

- Strengthened Supplier Relationships

Just as sellers benefit from enhanced relationships with buyers, the converse is equally true. When suppliers see that a buyer is willing to work collaboratively to establish mutually beneficial payment terms, it fosters trust and goodwill.

Over time, this can translate into perks like priority servicing, exclusive deals, or first access to new products and offerings.

- Reduced Financial Strain during Uncertainties

Economic uncertainties and market volatilities are inevitable. Flexible payment terms act as a safety net for buyers, allowing them to adjust their financial commitments based on prevailing conditions.

Whether it’s a sudden market downturn, unexpected operational expenses, or other unforeseen challenges, having the leeway to renegotiate payment terms can be a lifeline. As a result, it reduces the Financial Risk in B2B engagements.

- Empowerment in Business Planning

With the predictability and adaptability offered by flexible payment terms, buyers can plan their business ventures with increased confidence. Whether it’s launching a new product or undertaking a significant investment, knowing there’s flexibility in payment schedules empowers buyers to take calculated risks and pursue ambitious goals.

How will B2B Commerce Change?

In the intricate dance of B2B transactions, payment terms play an understated yet pivotal role. Historically tethered to rigid structures, businesses often found themselves navigating the challenges of cash flow bottlenecks, strained relationships, and missed opportunities.

However, the winds of change are blowing, especially in burgeoning sectors like B2B Commerce India. Thus, bringing to the forefront the transformative potential of Flexible Payment Terms.

The benefits of this adaptability are manifold and mutual. Sellers find themselves with better cash flow management, enhanced relationships, and reduced financial risks.

On the flip side, buyers enjoy optimised procurement strategies, increased negotiation leverage, and a more proactive approach to cash flow management. This symbiotic relationship, fostered by flexibility, is not just reshaping individual transactions but is redefining the very fabric of B2B commerce.

It promotes a culture of collaboration over competition, of partnership over mere transactions, and of strategic foresight over reactive management.

What Should You Do?

For those willing to embrace change, the path ahead is clear. Re-evaluate your existing payment frameworks, foster open dialogues with your business partners, and consider the adoption of flexible payment terms.

In doing so, you’re not just optimising a single facet of your business; you’re gearing up for a future where B2B transactions are more agile, responsive, and resilient.

As we look ahead, one thing is evident—flexible payment terms are more than just a trend; they’re shaping the future of B2B commerce. And in this future, adaptability, collaboration, and strategic financial planning reign supreme.